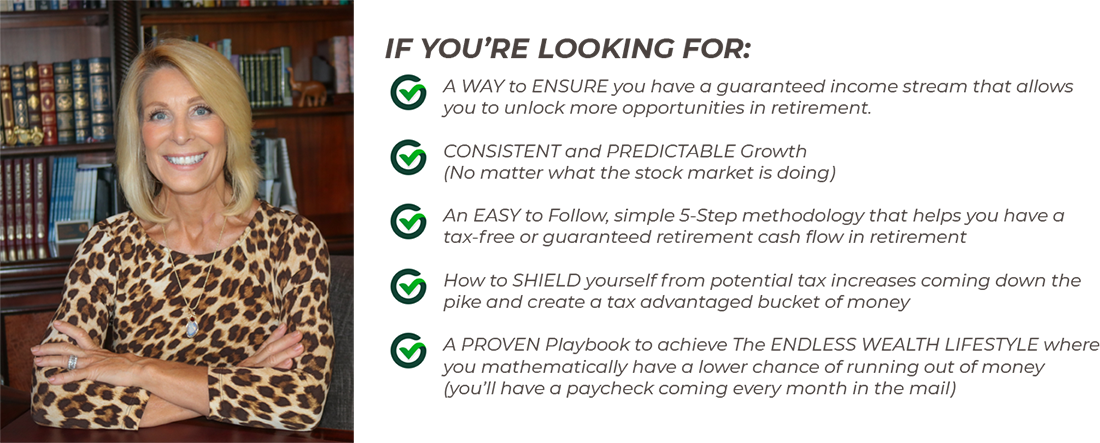

Susan has spent the last 30 years perfecting her S.P.E.N.D More Method. First she integrated the principles into her own life. Then she started helping others.

Over the last 30 years, she’s helped multiple other families implement the process in their own lives and across many different generations. In fact, some families have been reaping the benefits of the S.P.E.N.D Method across multiple generations.

Susan often says,

“Once you realize how to set up wealth and income for generations, your life completely changes.”

She only works with a select few clients a year that are a fit for this process.

It’s not for everyone. Some can’t see the power of locking in a portion of their retirement assets so they can unlock so many other opportunities.

Or they don’t see the value in switching the status quo that has been taught for years...where nestegg is more important than income.

In Susan’s process, the math proves that if you have a guaranteed income for a portion of your retirement assets, you can have a happier, healthier retirement. (1)

The math also shows that you have a lower probability of running out of money if you have a guaranteed income stream and the rest of your retirement assets are in an investment grade portfolio. (2)

Plus...by creating an “Endless Wealth StreamTM” in retirement, the math shows that you can actually spend more in your non-working years...plus your investing portfolio could actually perform better.

As you work through the 5 steps, you see how you can create a situation where you could have guaranteed income today...but also, how you might be able to create Generational Income for your family for years to come.

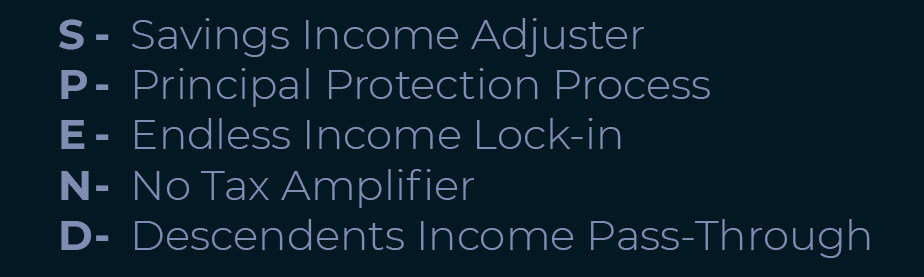

Here are the 5 Steps in the SPEND More Method

In Susan’s 5-Step “S.P.E.N.D.” process, each step has been honed down over the past 30 years.

This S.P.E.N.D. process could allow you to spend more throughout your life.

And achieve what Susan defines as retirement … ”The Endless Wealth Lifestyle”... where you know your living expenses are covered every month and you achieve a life of income liberation to travel, spend time with friends and family, start a new business, or turn a hobby into a cash flow.

This could happen by achieving “The Endless Wealth Lifestyle!”